The first new report is entitled, "Benchmarking Non-Hardware Balance-of-System (Soft) Costs for U.S. Photovoltaic Systems, Using a Bottom-up Approach and Installer," and is based on contributions from 77 residential and commercial PV installers.

It is a follow-up to an earlier study, but offers a more in-depth look at non-hardware business process and installation costs associated with photovoltaic (PV) solar energy systems.

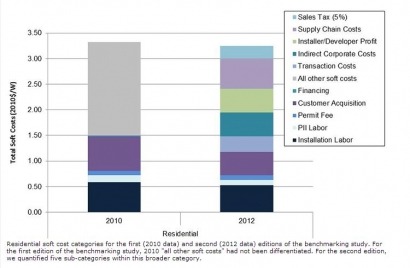

The authors found that in the first half of 2012, soft costs represented the majority of all costs — 64 percent of the total price for residential systems, up from 50percent of the total price in the first edition.

Similar results were found for small and large commercial installations — 57 percent of the total cost for small (less than 250 KW) commercial systems (up from 44percent); and 52 percent of the total costs for large (250 KW or larger) commercial systems (up from 41 percent).

For residential systems, the greatest soft costs were supply chain costs ($0.61/watt), installation labor ($0.55/W), customer acquisition ($0.48/W), and indirect corporate costs ($0.47/W), such as maintaining office management and accounting functions.

Other soft costs examined for the report included costs for permitting, inspection, interconnection, subsidy applications and system design. Soft costs for small commercial (250 kW) systems were also collected and analyzed.

In contrast to the first edition of the report, the new report unpacked the "other" soft costs category, using a detailed "bottom-up" cost-accounting framework to quantify five sub-categories: transaction costs, indirect corporate costs, installer/developer profit, supply chain costs, and sales tax.

For the second report "Financing, Overhead, and Profit: An In-depth Discussion of Costs Associated with Third-party Financing of Residential and Commercial Photovoltaic Systems", researchers and industry developed and vetted a bottom-up analysis of costs associated with developing, financing, constructing and arranging the financing for third-party owned systems.

The model quantifies the indirect corporate costs required to install distributed PV systems as well as the transactional costs associated with arranging third-party financing. The authors conducted in-depth interviews with members of finance departments at large PV installation companies and collected data from corporate public filings.

They found that third-party ownership added $0.78 per watt for residential systems and $0.67 per watt for commercial projects. They also noted three of the main benefits of third-party financing arrangements:

Third-party financiers offer additional services, such as shopping for systems, maintaining systems, and applying for incentives.

Third-party financing may effectively lower the cost of energy over time through economics of scale.

Businesses offering third-party ownership of installations have gained approximately 70 percent of residential market share in the United States, driving much of the PV demand.

For additional information: