The United States has approximately 44 million single family homes and millions more commercial buildings all readily suitable for the application of solar installations. The challenge for home owners and business has been to financing the equipment and installation in a cost-effective model.

The economics of solar power have been dropping over the last decade and are now approaching grid parity with non-renewable energy sources. The advancement in panel efficiency, technology and cost structures make solar energy a viable peak-load energy source. Local, State and federal regulatory and tax policy has encouraged the development and deployment of solar energy in a distributed model.

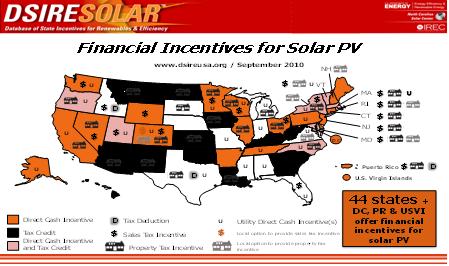

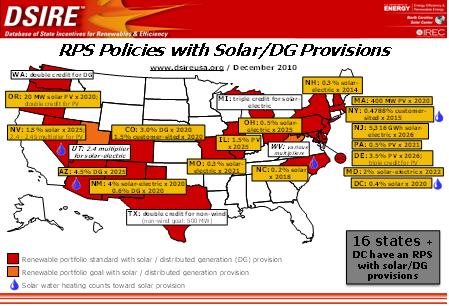

Twenty nine states have Renewable Portfolio Standards (RPS) that require the state’s utilities to generate a portion of their energy portfolio from renewable energy sources or pay a cost for non-compliance of the RPS guidelines. Forty four states offer some type of financial incentives for solar energy / distributed provisions (see Figure 1 and 2 for details). Federal policies provide various structural and policy incentives, including a cash-grant in lieu of tax-credit, residential energy conservation subsidy, accelerated and bonus depreciation (bonus depreciation was effective from 2008-2010 only) and other credits.

The effective cost of deploying a solar system various by State and Local incentives but upfront cost has been a road-block for most home owners and small business. Traditionally the choice of financing available for solar systems used to be limited to unsecured personal loans, home-equity financing, personal cash outlay, credit cards and installer financing, which has been a road-block to large scale adoption of solar systems in the consumer market.

In this paper we will review the development and benefits of Solar Lease Structures (SLS) and Solar Power Purchase Agreements (SPPA) that have developed as an alternative to the traditional financing techniques. We will close with some thoughts on application of securitization technology in financing SLS and SPPA assets.

Starting in 2006 an innovative new structure was applied to residential and commercial solar lease projects to provide consumers an alternative structure to finance and install solar equipment on their property and take advantage of sustainable clean energy. Over the last four years approximately 100,000 systems have been installed that have used a form of SLS or SPPA. The benefits of distributed solar energy systems include:

1. A predictable electricity cost over the life of the system, which can be 25 years or longer

2. Provide back-up power security in the event of a blackout

3. Reduce the load on the utility and provide environmentally safe clean energy

4. Flexibility to grow with demand and technology improvements

5. Generate local jobs for the community

The SPPA structure

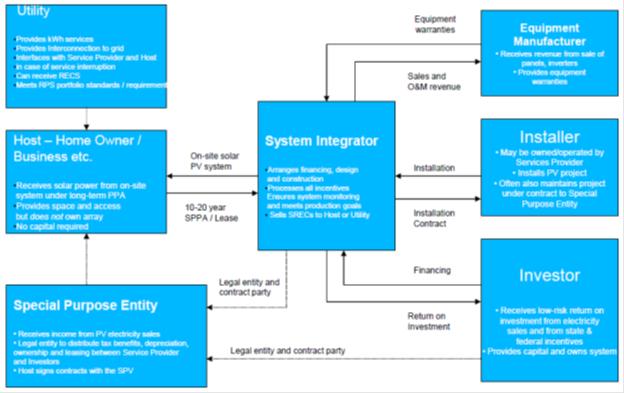

For a typical SPPA installation the system integrator is responsible for the financing, designing, installing, monitoring, and operation and maintenance of the system that is installed at a Host site. The Host does not pay any of the cost for installation, but buys the electricity the system generates. The utility in this case is on your own roof and you buy to power from the system integrator just as you would from your local utility.

The cost of the power is predetermined upfront so you know what the cost will be over the life of the system. Typically the contracts are for 15 to 20 years. SPPA may have a small escalation percentage over the life of the contract and can range from 1-2%. The benefit of the SPPA structure is that you don’t have unexpected price fluctuations as a result of price volatility in the commodities markets. The ideal customer for a SPPA is commercial customers that uses a large amount of electricity, generally 200,000 kWh annually, controls their own property, have a strong credit profile, have adequate roof space and are in a pro-solar policies region (See Figure 1 and Figure 2).

The benefits of SPPA structures in summary allow the Host to benefit from:

1. No upfront expense in order to buy the equipment for solar power

2. Negotiated electricity rates for the term of the contract, typically 15 to 20 years

3. Production monitoring and metering by the system integrator

4. System integrator / Investor Owner responsible for Operation and Maintenance

5. Supports local RPS standards and provides for Green Policy Certification

6. Energy production guarantee provided by system integrator

7. Option to purchase the system at fair market value at contract expiration

The Solar Lease Structure

Similar to a SPPA structure the system integrator for SLS, is responsible for the design, integration, financing, operation and maintenance of the system. The solar lease model is typically used for a residential customer (Host) to reduce the cost of electricity but can have commercial applications as well. Instead of purchasing a solar system for an upfront cost, the Host agrees to lease the system from the system integrator / Investor and pay as you go on a lease basis. This allows the Host to pay a low monthly cost and also reduce its monthly electricity cost from the local utility. In most situations the Host starts saving money from the first day. The system integrator takes responsibility for the performance of the system and guarantees that the system will produce the amount of power they projected. They track the performance and can fine tune the system for optimal efficiency. If the system produces more power than the system integrator had estimated, it only benefits the Host by reducing the amount of utility energy the use. The solar lease / SPPA market has grown considerably and approximately 70% of new installations use a Lease / SPPA structure. Cost savings can rage up to 30% depending on the region where the system is installed. Typical characteristics of a SLS / SPPA system are:

1. Residential system – $25-50K; Commercial system - $1.5M+

2. 25 year performance warrantees

3. Mature technology

4. Host agreements contract length ranges from 10-20yr contracts for monthly lease / SPPA payments (energy)

Figure 1. Renewable Energy Incentives (**)

(*) Source DSIREUSA.org

Figure 2. Renewable Energy Policies and Distributed Generation Provisions

(**) Source DSIREUSA.org

Capital Markets Applications

Solar energy is an effective source of clean, sustainable and renewable source of energy and can reduce the cost and price volatility for a Host customer. Distributed development of solar energy on existing roof tops can help manage peak demand loads for local utilities and help provide a reliable source of energy for the host. The systems can be monitored and tuned remotely for optimal efficiency. The availability of SLS and SPPA structures allows the Host customer to incorporate solar energy without high upfront equipment and installation cost. Investors can benefit from a new asset class that utilizes a mature technology with a history of operating experience. Typically SLS and SPPA structures segregate the investor entity into a special purpose entity that isolates the assets and cash flow from the system integrator and other stake holders. The standardized structures can be pooled and can benefit from diversification of the portfolio. Financing structures can be pooled and securitization structures for “SolarBonds” could potentially be created from the pools. Tranches can be customized according to investor risk appetite or the pools can be sold on a whole-loan basis. See figure 3 for a stylized structure for a SLS/SPPA application.

Figure 3. Solar Leasing / Solar Power Purchase Agreement

Solar SLS and SPPA structures are a new asset class which is at the early stage of development. The growth potential is vast, with only 100k system deployed out of potential 50+ million residential and commercial systems. We expect Local, State and Federal policy to continue to favor renewable energy deployment and expand the Renewable Energy Portfolio requirements to a higher percentage of utilities total energy generating portfolio. Distributed generation of solar energy is an efficient way for utilities to meet the requirements for RPS standards. The market is poised to grow rapidly over the next few years and could become a core alternative asset for investors with a good credit and yield profile. Application of securitization and structured finance techniques can provide greater amounts of capital to the sector and help develop the market for “SolarBonds”.