Already, extreme weather events in the U.S. are costing the property/casualty insurance sector billions of dollars in underwriting losses. No wonder the industry is reexamining its role in a low-carbon economy.

According to Stormy Future for the U.S. Property/Casualty Insurers: The Growing Costs and Risks of Extreme Weather Events, a new report from the Ceres organization, the effects of climate change are now discernible throughout the world.

For example, insured losses in the U.S. due to extreme weather events in 2011, a record year for federal disaster declarations, exceeded $32 billion. Considering that only one hurricane struck U.S. coastlines that year, losses during an active hurricane season could have been far worse.

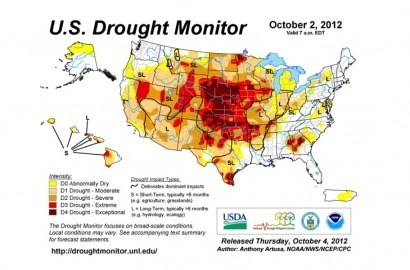

Insurers are also concerned about drought conditions in a number of important agricultural regions of the world, including the U.S., where insured crop losses may amount to $18 billion this year.

Because of reinsurance agreements between crop insurers and the federal government, U.S. taxpayers will be responsible for about $10 billion of this amount, but insurers will have to cover the balance. As of October 2, about 65 percent of the contiguous U.S. was experiencing some form of drought.

In addition to crop losses, severe drought can sow seeds of public unrest. In his recent essay, Why 2013 Will be a Year of Crisis, CNN contributor David Frum predicts that we are headed toward a serious global crisis due to the expected rise in food costs in developing nations caused by drought in the U.S. and elsewhere. The CNN story contends that as global food prices increase, particularly for grain, history shows that civil unrest will spread: “Hungry people are angry people, and angry people bring governments down.” While not directly addressed in the Ceres report, you can bet insurers will be watching world events very carefully as the climate warms.

Other climate change issues, including wildfires, sea-level rise, and flooding, are grabbing the attention of insurers. In the U.S., losses from excessive precipitation from 2008 through 2011 were the highest on record, winter storm losses have almost doubled since the 1980s, and over 25,000 record high temperatures have been set so far in 2012, according to Ceres.

What can the insurance industry do? In addition to supporting climate research, improving extreme weather event modeling, and working with city planners to make buildings more resilient and disaster-resistant, the Ceres report recommends that the insurers promote clean energy and low carbon emissions:

As society’s risk managers, insurance markets must reflect the reality of climate change and heightened risk through their pricing and underwriting … By reducing green house gas (GHG) emissions we can still limit the severity of climate change impacts. Insurers must also help enable the transition to a low-carbon economy by offering new products and services that promote the scaling of clean and efficient uses of energy; encouraging customers to adopt climate-change mitigation practices that lower their carbon emissions footprint; and encouraging policymakers to take steps to reduce carbon emissions.

Many insurance agencies and organizations are already taking steps to mitigate the effects of climate change. (See my February 28, 2012, Renewable Energy Magazine posting.) One example is the ClimateWise program, which promotes collaboration among insurers to better understand and address climate change risks. According to Ceres, “This should serve as a model for all insurers, and is most certainly in their own best interests, as well as that of society at large.”

Renewable energy will play an increasingly important role as the insurance industry grapples with the realities of a warming climate. The promotion of renewable energy technologies, combined with new insurance products, services, and incentives, will help the world make progress toward a low-carbon society, perhaps making that lofty goal a bit less elusive.

* Information on the illustration: The U.S. Drought Monitor is produced in partnership between the National Drought Mitigation Center at the University of Nebraska-Lincoln, the United States Department of Agriculture, and the National Oceanic and Atmospheric Administration. Map courtesy of NDMC-UNL.