Is it just me or are the big guys missing an opportunity? The trend in wind turbine technology is towards larger capacity turbines with longer blades and larger rotor diameters as manufacturers strive to increase capacity factor and output and lower the cost wind energy production.

The big names in the industry include Vestas, GE, Siemens, Enercon, Gamesa, Sinovel, Suzlon, Goldwind, and Dongfang. These players are in a league of their own in terms of market share, R&D expenditure and manufacturing output. But what about medium-sized turbines?

Non-utility scale 200-500kW turbines for farmers, small businesses and communities looking to utilise the Feed-in Tariff (FiT)? There are a limited number of manufacturers with a proven track record currently supplying turbines in this range to the UK market. With the exception on Enercon and Gamesa, the big players have moved on from this market, leaving their licences (and much of the R&D capacity) to smaller manufacturers and new market entrants.

Notable manufacturers at this level including Emergya Wind Turbines (EWT), Powerwind, RRB Energy, Wind Technik Nord (WTN), Turbowinds, and Global Wind Power (GWP) use turbine technology derived from either Vestas or Lagerway. These manufacturers are servicing the 100-500kW market where the FiT band of £0.197/kWh applies. A 500kW installation will cost in the region of £1-£1.5million to develop and construct. In an area of average annual wind speed of 7m/s at hub height, the turbines can generate between £300,000 and £400,000 in annual FiT revenue plus £45,000-£60,000 in annual export revenue. That’s a pretty attractive investment, but in reality few of these projects have come to fruition.

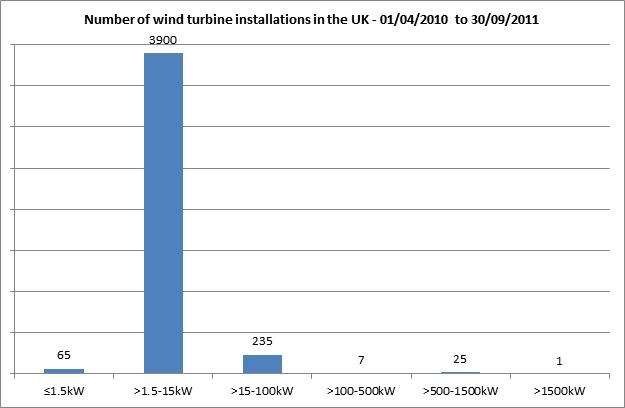

Paradoxically, of the 4,233 wind turbine installations registered with Ofgem for FITs to date, just 7 are in the 100kW-500kW range, as shown in the chart below. Why? The answer is three-fold; 1) planning risk; 2) lack of financial strength of the manufacturers; 3) lack of available project finance for one or two turbine developments.

The issue of planning was addressed in my previous blog ‘Time is Money’, so I won’t dwell on this here.

There are a limited number of turbine manufacturers with a proven track record of supplying turbines to the 100kW-500kW market in the UK and a strong balance sheet for banks to lend against. Consequently, high street banks aren’t providing project finance for single projects which leaves project owners with two options; raise the cash or apply for a securitised loan. A lack of project finance is bad news for a start-up project developer with limited cash and a weak balance sheet. There is a great opportunity for one of the big turbine manufacturers to partner with developers and project owners and quickly accumulate market share in a newly established, but rapidly evolving FiT market.

Supply chain development is a critical issue at this stage of market development. Technology manufacturers need to work with project developers and engineering contractors to provide reliable turn-key solutions backed by comprehensive contractual framework that de-risk projects for investors and lenders. Similarly, developers need to work with turbine manufacturers to accurately forecast production requirements, increase turbine availability and improve lead times.

So why, with their proven technology, delivery capability, and industry experience, aren’t the big boys in this part of the playground? Do they have bigger fish to fry, or are they simply missing the trick?

[Source: Ofgem]