The latest long-term forecast from Bloomberg New Energy Finance shows sales of electric vehicles, increasing from a record 1.1 million worldwide last year to 11 million in 2025, and then surging to 30 million in 2030 as they establish cost advantage over internal combustion engine cars. China will lead this transition, with sales there accounting for almost 50 percent of the global EV market in 2025 and 39 percent in 2030.

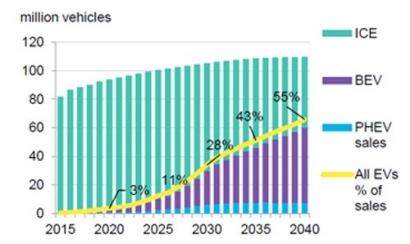

The sale of conventional vehicles is expected to begin a decline in the mid-2020s, as EVs bite hard into their market. In 2040, some 60 million EVs are projected to be sold, equivalent to 55 percent of the global light-duty vehicle market. ‘Shared mobility’ cars will be a small but growing element (see below).

The advance of e-buses will outpace even electric cars, according to BNEF’s analysis. It shows electric buses in almost all charging configurations having a lower total cost of ownership than conventional municipal buses by 2019. There are already over 300,000 e-buses on the road in China, and electric models are on track to dominate the global market by the late 2020s.

Colin McKerracher, lead analyst on advanced transportation for BNEF, commented, “Developments over the last 12 months, such as manufacturers’ plans for model roll-outs and new regulations on urban pollution, have bolstered our bullish view of the prospects for EVs. The changes to our forecast this time compared to the previous one a year ago are modest, at least as far as cars are concerned. We now think EVs will be 55 percent of light-duty vehicle sales in 2040, rather than 54 percent, and represent 33 percent of the total car fleet worldwide.

“But the big new feature of this forecast is electric buses. China has led this market in spectacular style, accounting for 99 percent of the world total last year. The rest of the world will follow, and by 2040 we expect 80 percent of the global municipal bus fleet to be electric.”

BNEF expects the transition in transport to have major implications for electricity demand, and for the oil market. EVs and e-buses will use 2,000TWh in 2040, adding 6 percent to global electricity demand. Meanwhile, the switch from ICE to electric vehicles is forecast to displace 7.3 million barrels a day of transport fuel.

The BNEF team has taken a detailed look at whether the increased appetite for metals such as lithium and cobalt resulting from the rise of electrified transport could lead to supply shortages for these key metals.

Salim Morsy, senior transportation analyst, said, “While we’re optimistic on EV demand over the coming years, we see two important hurdles emerging. In the short term, we see a risk of cobalt shortages in the early 2020s that could slow down some of the rapid battery cost declines we have seen recently. Looking further out, charging infrastructure is still a challenge.”

The outlook for EV sales will be influenced by how quickly charging infrastructure spreads across key markets, and also by the growth of ‘shared mobility’.

Ali Izadi-Najafabadi, lead analyst for intelligent mobility at BNEF, said, “We predict that the global shared mobility fleet will swell from just under 5 million vehicles today to more than 20 million by 2040.”

BNEF forecasts that in 2030, EVs will make up 44 percent of European light-duty vehicle sales, 41 percent of those in China, 34 percent in the U.S., and 17 percent in Japan. However, a shortage of charging infrastructure and a lack of affordable models will hold back the market in India, so that EVs will make up just 7 percent of new car sales in 2030 there.

BNEF’s projections imply big opportunities for lithium-ion battery manufacturers. China is already dominant in this market, with a 59 percent global share of production capacity in 2018, and this is forecast to rise to 73 percent by 2021.

More information on BNEF’s 2018 Electric Vehicle Outlook can be found at Bloomberg New Energy Finance