The market in Asia is flagging at a high level and still shows the worldwide largest capacity increases. These are the results of ecoprog’s latest market analysis.

Today, there are almost 2,900 active biomass power plants (BMPPs) worldwide, with an electrical capacity of around 47 GWel. Additionally, biomass is co-incinerated in coal power plants.

This is so far mainly happening in European countries such as Denmark, the Netherlands and the UK. However, Japan and South Korea are also steadily increasing the combustion of pellets in coal-fired power stations.

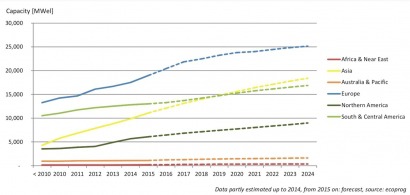

By 2024, the number of BMPPs will increase to 4,250, the overall capacity to 71 GWel. This means that the plants’ total capacities will almost double. The countries with the strongest developments will be the USA, Brazil, China, India, the UK and France.

The most important market stimulus is the granting of subsidies for electricity generation from renewable energy sources, and by now more than 140 countries have introduced such support schemes. The most attractive schemes for electricity generation from solid biomass are established in Europe. In the past years, more and more Asian countries have also introduced such biomass subsidies.

The support schemes in Europe have been established for a long time and are thus very versatile. At present, however, subsidies are declining in many countries, due to high costs and for ecological reasons.

The Czech Republic has even stopped subsidisation completely. Germany, which had been a large growth market, reduced and capped financial incentives to an extent that the construction of additional plants has almost come to a standstill.

France and the UK have by contrast newer and quite attractive legislation, which makes them the most dynamic markets in Europe. Planning reliability will also return to Poland in early 2016, when, after many years of delay, a new support scheme based on auctions will be introduced.

The Asian biomass market is not developing as dynamically as expected. Large markets such as China and India show first signs of saturation, e.g. high fuel prices and project withdrawals. Additionally, smaller Asian states such as the Philippines only grant low and limited subsidies.

Many market players furthermore state problems with logistics and funding shortfalls as main reasons for the sometimes sluggish development of capacities.

Still, from 2017 onwards, Asia will see a stronger increase of capacities than Europe. This is due to the fact that mostly large-scale projects are realised in Asia, with capacities between 10 and 30 MWel. In Europe, by contrast, small-scale plants of up to 5 MWel benefit the most from the local support schemes, which is why most newly constructed facilities will have such a capacity range.

Furthermore, using the plants’ waste heat is obligatory in many European countries. The plants there are thus equipped with efficient heat use technology and located at industrial sites or district heating grids.

The small plant size, the common design as CHP facilities and high environmental standards in Europe result in average investment costs of €5.6 million per MWel, which is significantly more than in Asia. The investment costs in Asia, and especially in China, are lower due to standardised plants that generate electricity only.

In monetary terms, Europe will thus remain the most important BMPP market in the next 10 years – even though the development of capacities will decrease considerably when compared to the past 5 years.

For additional information: