Corporations bought a record amount of clean energy through power purchase agreements, or PPAs, in 2018, shattering the previous record set in 2017. Highlights included a wave of smaller corporate energy buyers aggregating their purchases, and the first corporate clean energy power purchase agreements in markets such as Poland.

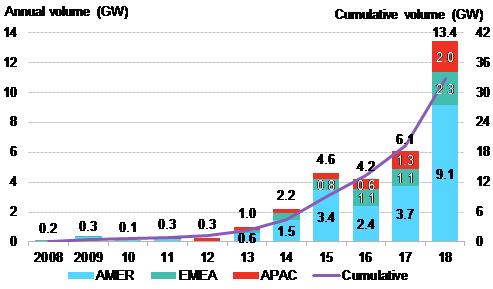

BloombergNEF (BNEF) finds in its 1H 2019 Corporate Energy Market Outlook, published yesterday (28th January), that some 13.4 GW of clean energy contracts were signed by 121 corporations in 21 different countries in 2018. This was up from 6.1 GW in 2017, and positions companies alongside utilities as the biggest buyers of clean energy globally.

“Corporations have signed contracts to purchase over 32 GW of clean power since 2008, an amount comparable to the generation capacity of the Netherlands, with 86 percent of this activity coming since 2015 and more than 40 percent in 2018 alone” said Jonas Rooze, head of corporate sustainability for BloombergNEF (BNEF).

Figure 1: Global corporate PPA volumes

Source: BloombergNEF. Note: Data in this report is through 2018. Onsite PPAs not included. Australia sleeved PPAs are not included. APAC number is an estimate. Pre-market reform Mexico PPAs are not included. These figures are subject to change and may be updated as more information is made available.

More than 60 percent of the global activity in 2018 occurred in the US, where companies signed PPAs to purchase 8.5 GW of clean energy, nearly triple the amount signed in 2017. Facebook spearheaded a contingent of experienced US corporate energy buyers, purchasing over 2.6 GW of renewables globally in 2018, primarily with utilities in regulated US markets through programs known as green tariffs. This was three times that of the next biggest corporate energy buyer, AT&T.

ExxonMobil became the first oil major to sign a clean energy PPA for its own operations, purchasing 575 MW of solar and wind in Texas. Mexico and Brazil also saw growth in corporate procurement, rounding out the 9.1 GW of clean energy purchased by companies in the Americas region in 2018.

In the US a major feature was the emergence of smaller, first-time corporate clean energy buyers. In 2018, some 34 new companies signed their first clean energy PPAs, making up 31 percent of total activity in the US. These firms are aggregating their electricity demand to reap the economies of scale from larger solar and wind projects. In many cases, they benefit from partnering with a bigger, more experienced buyer – known as an anchor tenant – who can offer a stronger balance sheet and expertise on accounting and legal nuances when signing a PPA.

“The aggregation model has heralded in a new generation of corporate clean energy buyers” added Kyle Harrison, a corporate sustainability analyst for BNEF and lead author of the report. “These companies no longer need to tackle the complexities of clean energy procurement alone. They can share risks associated with credit and energy market volatility with their peers.”

In the Europe, Middle East and Africa (EMEA) region, corporations also purchased record volumes of clean energy, agreeing deals for 2.3 GW and doubling the 1.1 GW signed in 2017. The Nordics were once again the hot spot for activity, with companies attracted to strong wind resources and credit support from government bodies. Aluminium producers Norsk Hydro and Alcoa Corp purchased the most clean energy in Europe in 2018, but the region also saw activity from multinational technology companies such as Facebook, Amazon and Alphabet subsidiary Google.

Several European countries that saw little or no corporate procurement activity in 2017 enjoyed a rise in interest in 2018. Companies signed PPAs for the first time in Poland, and just the second time in Denmark and Finland. There were also new deals signed in the U.K., following a lull after the expiration of a national subsidy program. Several requests for proposals and changes in policy suggest burgeoning new markets in Germany and France as well.

In the Asia-Pacific (APAC) region, still a nascent market for corporate procurement, companies signed a record 2 GW of clean energy PPAs, more than the previous two years combined. Nearly all of this activity occurred in India and Australia, with roughly 1.3 GW and 0.7 GW of clean energy purchased, respectively. Both markets allow companies to buy clean energy at a large scale through offsite PPAs, making them rarities for the region.

Demand still far outstrips supply in the rest of APAC, although recent changes in several markets suggests a major spike in activity is on the horizon. Offsite corporate PPA mechanisms are now available in nine provinces in China, and the imminent passing of a renewable portfolio standard will give over 30,000 large commercial and industrial companies renewable electricity targets. In Japan, the country’s third non-fossil certificate auction saw corporations purchase 21 TWh, tripling the combined activity in the first two auctions. Thirteen companies in Japan have also established 100 renewable electricity targets, more than the rest of APAC combined.

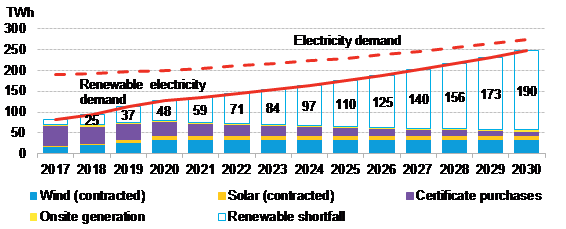

The healthiest signal of continued growth in the global corporate procurement space is the growing alliance of companies establishing clean energy and sustainability commitments. One such campaign, known as the RE100 – consisting of nearly 160 signatories at the end of 2018 that have established 100 percent renewable electricity targets – has companies domiciled in 23 different markets. Cumulatively, these companies consumed an estimated 189 TWh of electricity in 2017, equivalent to Egypt’s electricity consumption.

BNEF estimates these companies will need to purchase an additional 190 TWh of clean electricity in 2030 to meet their RE100 targets. Should this shortfall be met with offsite solar and wind PPAs, it would catalyse an estimated 102 GW of new solar and wind build globally, greater than the size of the U.K.’s power generation fleet in 2017 (see Figure 2 below).

“For companies that think seriously about sustainable growth, establishing clean energy and decarbonization targets lines up naturally with overall corporate strategies” said Jonas Rooze. “At the same time, these initiatives have created an entire new universe of opportunity for utilities, clean energy developers and investors.”

Figure 2: Projected renewables shortfall for RE100 companies

Source: BloombergNEF, Bloomberg Terminal, The Climate Group, company sustainability reports. Note: Charts are for RE100 members that have disclosed electricity demand. Certificate purchases includes non-U.S. green tariff programs, and are assumed to step down 10% each year. Onsite generation and contracted wind and solar purchases are assumed to remain flat through 2030. Regional breakdown of shortfall estimated based on each company’s share of revenue by region.

For additional information: