Being an entrepreneur in the clean tech industry can be hard going. To be successful, it takes time, regulatory support, access to the right technology, resources, and money combined with industry know-how and great teamwork. Every business faces these broad issues, however over the next few months this blog will discuss how each of these issues impact on the clean tech sector in particular and hopefully assist readers in addressing them.

The blog will be UK-centric initially but comments from abroad are most welcome. So feel free to contribute to the discussion; perhaps you have differing views on the issues faced by the clean tech sector, are facing other key issues in your business or market sector (solar PV, energy efficiency, geothermal, green e-business, etc.), or just want a sounding board for your clean tech ideas.

Building a profitable AND sustainable clean tech business requires long-term vision and on-going commitment to the core principles of sustainability; economy, society and the environment. This presents a challenge outside of the conventional realms of business, particularly for start-ups with limited money and resources at their disposal.

Like many clean tech entrepreneurs in the UK, I decided to jump aboard the renewable energy band wagon and in January this year joined a start-up project developer and financier of medium-scale Feed In Tariff (FIT) eligible onshore wind energy developments. In six short months we have covered a lot of ground, developing a pipeline of almost 40 projects across the UK with a combined energy generating capacity of 15MW. But a pipeline is meaningless without conversion within the required timeframe for investment return. And as with any business this takes time, regulatory support, access to the right technology, resources, and money combined with industry know-how and great teamwork.

With this in mind I’d like this blog to be a place where these issues (plus others) can be explored further as they are key to the growth of our business and I’m sure many others in what is an evolving and politically challenging market sector.

Time is money

It can take a great deal of both time and money to take a project from initial feasibility and planning through to financial close, then construction and commissioning. For larger projects, say over 5MW, this can take years and millions of pounds. Most start-ups can’t stomach that timeframe as cash is limited, has competing investment opportunities (i.e. opportunity cost), and shareholders or equity partners quite often won’t accept the risk associated with long lead-in times. Risks to onshore wind energy projects in the UK are primarily related to planning and grid connection. De-risking the planning stage requires careful site selection coupled with a community engagement strategy that successfully communicates the benefits a proposed development will deliver to local communities.

The other issue is grid connection. There are 14 licenced Distribution Network Operators (DNOs) in the UK and some network operators are better to deal with than others depending on the number of connection applications within a particular network area. Electricity distribution networks are monopolies because there is only one owner/operator for each area so the DNOs are in the box seat when it comes to negotiating connections. Connection quotations for FIT projects can take up to 6 months to finalise and they aren’t free which adds cost to the development budget.

The guiding hand

There are two main regulatory support mechanisms for the renewable energy industry in the UK; the Renewables Obligation (RO) and the Feed In Tariff (FIT). The RO is the primary mechanism supporting large-scale renewable energy generation. It was introduced in 1990 (under the Non Fossil Fuel Obligation) and obligates electricity suppliers to source increasing amounts of generating capacity from renewables. In April 2010 the Government introduced the FIT to work alongside the RO to support the deployment of sub-5MW renewable energy installations.

The FIT provides a fixed premium payment for electricity produced from installations for 20-25 years, thus providing greater financial certainty for investors than the RO which is a market-based mechanism. However, investor confidence was knocked when DECC carried out its first FIT review in February and slashed the tariff for large scale solar PV schemes much earlier and much more significantly than anyone expected. It would be great to hear from a solar PV developer who could explain how these changes have impacted on their business. Please comment below!

The Government also intents to introduce a Renewable Heat Incentive (RHI) in late 2011/early 2012 to provide long-term financial support to renewable heat installations, ground-source heat pumps to wood-chip boilers. This will create investment opportunities similar to the FIT with a fixed, 20-year premium payment for heat produced from qualifying installations.

Further information on the UK’s renewable energy policy can be found on the Department of Energy and Climate Change website.

Back to the future

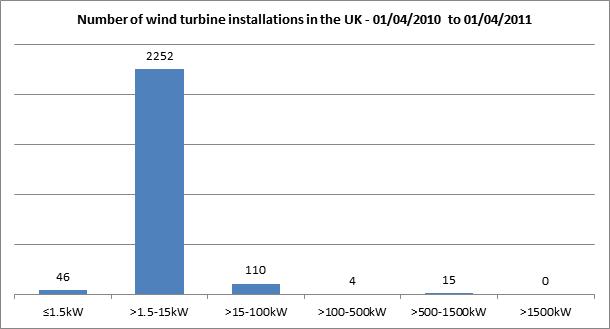

The trend in wind turbine technology is towards larger capacity turbines with longer blades and larger rotor diameters as manufacturers strive to deliver the lowest cost of energy. Consequently, there are a limited number of reputable turbine manufacturers with a proven track record of supplying turbines in the 200kW to 500kW range to the UK market. The medium-scale turbines (200-500kW) are either based on existing technology or larger machines (typically 600-900kW) with de-rated generators to qualify for the attractive 100-500kW FIT band of £0.197/kWh. The chart below shows that of the 2,427 wind turbine installations registered for FITs to date, only 4 are in the 100kW-500kW range.

(Source: Ofgem)

This presents a problem for project developers and investors looking to deploy assets in this range as debt financiers are reluctant to lend money for relatively low-cost projects (circa £1 million capex) involving technology with little track record, particularly in the absence of parent company guarantees to cover for potential technical, operational and construction related risks.

Nevertheless, medium-scale onshore wind still presents an attractive investment opportunity particularly with the FIT in its current form. Technology and supplychain development are two critical areas to be addressed at this stage of market development. Technology manufacturers need to work in partnership with technology integrators (i.e. engineering contractors) to provide reliable turn-key solutions backed by comprehensive contractual framework that de-risk projects for investors and debt providers. Similarly, developers need to work with turbine manufacturers to accurately forecast production requirements, increase turbine availability and improve lead times.

Labour + land = capacity creation

The wind industry in the UK is largely geared towards ‘big wind’, both onshore and offshore. The small to medium scale wind sector is comparatively under-resourced adding further time delays and cost to projects as developers search for the right planning and technical service providers. Additionally, medium-scale developments often face the same development hurdles as large-scale wind, namely visual impact and environmental impact assessments, which can significantly reduce the financial viability of such projects. Industry guidelines are geared to large-scale wind and the methodology is onerous and in some cases completely unnecessary.

In addition to this, developers are exposed to a limited area of land which is suitable for wind energy developments. A suitable site should have no conflicting current or future land use(s), adequate wind resource, be in proximity to a 3-phase grid connection point and access roads, sufficient distance from neighbouring residences, with the right ground conditions, no planning or agricultural designations (i.e. natural parks, site of specific scientific interest, area of outstanding natural beauty, ecological or cultural heritage constraints etc.), and no interference with telecommunications, aviation radars, or aircraft flight paths. Needless to say, these factors rule out a large proportion of available land in the UK.

Money makes the blades go ‘round

As a start-up developer and investor, our business model requires both equity and project finance. Equity is required to build and operate the business and take projects through feasibility and planning stages. Project finance is required to build the wind turbines. In 2008, the Global Financial Crisis disrupted the flow of both equity and debt finance into renewable energy projects. Three years later, the availability of project finance has improved with a return to longer term sheets (10-15 year debt terms) and the introduction of legislative support mechanisms such as the FIT which provides secure long-term revenue from renewable energy generating assets.

There are several factors which largely determine whether banks consider a FIT project to be ‘bankable’. These include the commercial terms of the PPA and FIT agreement (i.e. how much power is bought and for how much) plus the engineering, procurement and construction (EPC) contract, insurance coverage, balanced with the project’s associated market and technology risks.

Without a comprehensive EPC contract developers struggle to raise the cash through conventional methods (i.e. banks) to support a given project. The banks put every project under the microscope, looking for sufficient evidence of quality standards in construction and operation and appropriate due diligence on technology manufacturers and project partners. With a high degree of volatility in renewable energy operations, developers need to be covered from the construction phase, where equipment can be damaged in transit, through to the operational phase, where equipment failures can result in losses of power and ultimately revenue. There is a lot of risk in FiT wind projects and whilst the rewards are high, this risk must sit somewhere and generally this is with the developer or/and investor.

The ensuing blogs will delve into these issues in more detail and hopefully evoke interest from readers. Please add comments or suggestions for future areas of discussion and let me know if you would like any further information on the topics discussed.

[Photo inset: Courtesy of Cory Grunkemeyer’s Flickr stream]