Brent, fuels and CO2

The price of Brent oil futures for July 2019 in the ICE market showed a sharp drop in the middle of last week, settling on Friday, May 24, at 68.69 $/bbl, which represents a difference of 3.52 $/bbl with respect to the previous week. US sanctions on Iran and Venezuela continued to have an impact, along with the OPEC production cuts, which put pressure on prices on the supply side. However, the concerns related to demand and economic growth as a result of the commercial tensions between the United States and China, as well as the increase in crude reserves in the United States, had a greater impact the tension experienced by the market, causing the price to fall.

The TTF gas futures in the ICE market for June 2019 settled on Friday, May 24, at 12.25 €/MWh, 4.7% lower than the previous Friday. This market has been on a downward trend since April 9.

The price of CO2 emission rights futures in the EEX market for the reference contract of December 2019 settled on Friday, May 24, at 25.47 €/t, 1.8% higher than on Friday of last week. Despite the upward and downward changes over the past week, prices remain within the range of 24.70 €/t and 27.54 €/t. The resignation of the British Prime Minister Theresa May will cause this market to remain unstable, with the probability that the price will go down.

European electricity markets

The week of May 20, the price of most European electricity markets fell compared to the values registered the previous week, from 2.0% of the EPEX SPOT market of the Netherlands, to 8.8% of the IPEX market of Italy. During the last week the temperatures of the continent were higher compared to those of the previous week. Another highlight last week is that the market prices of Sunday, May 26, had negative values between hours 14 and 16 in the EPEX SPOT markets of Germany, France and Belgium, making the average daily price of these markets during this day to be around 21 €/MWh. The high renewable energy production in Germany, both wind and solar, together with the fact that the demand for a Sunday is lower, is the fundamental reason for the behavior of prices on the 26th.

The only European market in which prices increased last week was MIBEL of Spain and Portugal, with an increase of more than 4%, whose average weekly price was around 51 €/MWh. Although the electricity demand was lower last week, as in the rest of Europe, the drop in renewable energy production in the Iberian Peninsula compared to the previous week, of 33% in the case of wind energy and a 4.6% in the case of solar energy, as well as the reduction in available nuclear power due to the scheduled shutdown for refueling of the Ascó II and Trillo power plants, are the main elements that caused prices to rise.

Last week, the European markets continued to be divided into two groups according to their price. In the group of markets with the highest prices were the MIBEL market, which led the European electricity price ranking most of last week, the IPEX market of Italy and the N2EX marketof the UK.

In the group of markets with lower prices, most of the week with prices around 40 €/MWh or below, were the Nord Pool market of the Nordic countries and the EPEX SPOT markets of Germany, France, Belgium and Netherlands.

Electricity futures

The European electricity futures prices for the third quarter of 2019 returned to settle last week on Friday, May 24, with a generalized drop compared to the Friday of the previous week, except for the MTE market operated by GME that remains unchanged. The Nordic ICE and NASDAQ markets stand out in this fall, for which the decrease was close to 5%. For the rest of the markets, the decrease was between 0.3% and 3%.

However, in the case of the European electricity futures for the year 2020, although in some markets the prices fell, as in the case of futures of Spain and Portugal that had a reduction of around 0.5% and futures of the Nordic countries that had a decrease of around 1.8%, in the rest of the markets the prices went up between 0.1% and 0.9%. The price of Italian futures in the MTE market for the year 2020 remains unchanged, as do the futures of the third quarter of this year.

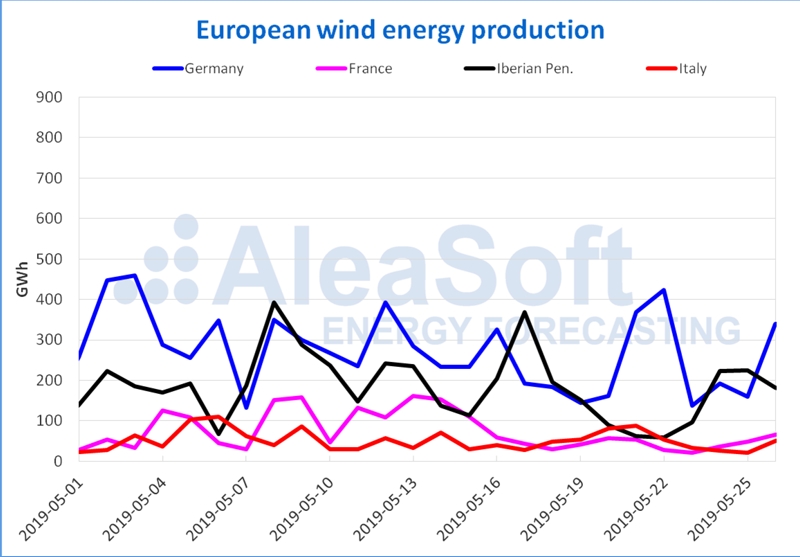

Wind and solar energy production

The wind energy production in France fell last week for the second consecutive week, this time by 48%, and also in Spain, by 34%. In Portugal it also dropped 30%. In Germany and Italy, the wind energy production recovered 11% and 17% respectively. For this week, of May 27, production with this technology is expected to rise in France, Spain and Italy, and lower in Germany and Portugal.

In the week just finished, solar energy production, which includes photovoltaic and solar thermal, suffered a reduction of 17% and 5% in Germany and Spain respectively, while it increased in Italy by 25%. For the current week, AleaSoft expects solar energy production will have a slight increase in Germany and Spain, and a small decrease in Italy.

Sources: Prepared by AleaSoft using data from ENTSOE, RTE, REN, REE and TERNA.