Twenty years ago we paid in pesetas; Bodo Illgner was the starting goalkeeper of Real Madrid; in the peninsula there was not even 50 gigawatts of installed capacity (today they are more than 100); and neither the natural gas of the combined cycle gas turbines, nor the wind energy, nor the photovoltaic solar energy, nor the solar thermal energy appeared in the registers of Red Eléctrica de España. AleaSoft Energy Forecasting was born in Barcelona 20 years ago, a company that today, 20 years later, offers, as then, a product –forecasts in the energy sector– that is sought after by the electricity generators, the retailers, the large consumers, the banks. REM interviews its founder, PhD. in Artificial Intelligence, Antonio Delgado Rigal.

What was the electricity sector like 20 years ago? How were the first years of the Spanish electricity market?

These days we are making a set of reports related to the history of the Spanish electricity market, since the history of our company in these 20 years coincides with that of the market. We divided the history of the electricity market into three parts: the first covers the first years of the market, between 1998 and 2008, just before the start of the economic crisis, the second covers the years of the crisis, between 2009 and 2014 and the third includes the years after the crisis, from 2015 to the present.

The first years of our company coincided with the beginning of the electricity market. The companies in the electricity sector were beginning to compete and needed scientific tools to make forecasts in all time horizons. It was an opportunity for AleaSoft because in a short time we were present in the main electricity companies of our country.

To summarize that first stage, the main feature was the continued growth of the electricity demand. In the period from 1998 to 2008 the demand had a growth of 53%, very similar to the growth of the GDP in the same period. In that first period, most of the combined cycle gas turbines were built, reaching a total capacity exceeding 21,000 megawatts [MW] in 2008. The installed wind power capacity, which in 1998 was almost null, reached 16,000 MW in 2008. The photovoltaic generation went from being almost non-existent in 2006 to having more than 3000 MW in 2008. In the first 10 years of the market there was a quantitative and qualitative change of great importance.

In that first stage of the Spanish electricity market, many of the decisions taken by the large companies in the country to go to market, generate the offers to buy or sell, make the midterm coverage or plan long-term investments, were made using our forecasts.

What did AleaSoft contribute to the electricity companies in those early years of the market with their forecasts? Digitalization and Artificial Intelligence?

In the VI Solar Forum organized by UNEF, that was just held in Madrid, we stated that, for decision making in the electricity sector, it is important to have the following: information, forecasts, probabilities associated with forecasts and optimization. In general, this is what AleaSoft brings to companies in the electricity sector.

In AleaSoft we have a database with all the history of the European markets. That history is the fundamental basis to be able to make a scientific forecast based on the market balance and fundamentals. The companies in the sector must have a large amount of information available at all times and that is one of the functions we help to perform. Having all this information available automatically is what is called “digitalization,” and is part of what we have been doing for 20 years.

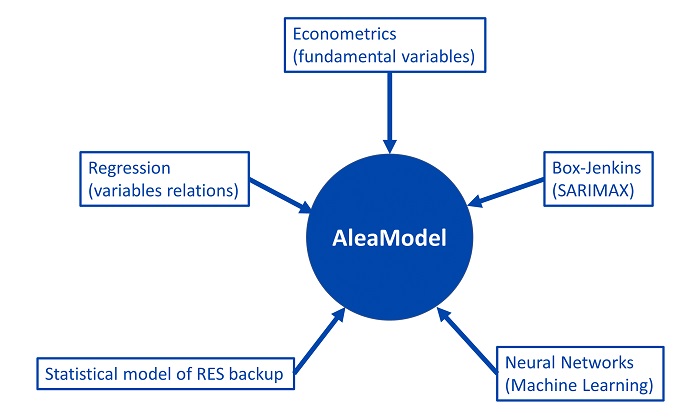

To make forecasts in the electricity sector, AleaSoft uses all available information, both historical and current, as well as other forecasts from other sources or from our own. We use Artificial Intelligence techniques, in this case recurrent neural networks as the basis of our models, combined with classical statistics techniques and the Box-Jenkins methodology.

To make the long-term forecasts we are taking into account all the changes that the market will face in the future and how some energy will be replaced by clean and renewable sources. But this replacement will not only occur in the electricity generation mix, but also in the energy sources for transportation or industry, which will also be replaced by electricity or hydrogen. It must be taken into account how all this will modify the volume and profile of the energy demand, with the flexibility, the storage and the production of hydrogen, and the generation of electricity.

Our own methodology and models provide the electricity sector with scientific and coherent forecasts.

What was the evolution of the combined cycle gas turbines and the wind energy production?

For many years there has been an awareness of producing electricity by reducing CO2 emissions and other polluting gases. The electricity production with coal is the one that most affects the environment, due to the high emission of CO2 and also of NOx and SOx. The emergence of the combined cycle natural gas turbines was a technological leap, because they are more efficient from the point of view of energy consumption, emit half of CO2 of coal and do not generate other polluting gases. Up to 2011, 67 combined cycle gas turbines were launched, totaling more than 25,000 MW.

The massive introduction of the wind energy generation in Spain in these 20 years was a great success in the fight for decarbonization. In 2018 we already had a production capacity of 23,500 MW, that is, more than 22% of the system's capacity.

These two technologies, the combined cycle gas turbines and the wind energy generation, are complementary since the wind energy generation varies depending on the wind and when it does not produce, the combined cycle gas turbines enter.

The increase in the wind energy production brought added complexity to the forecast of electricity market prices in the short and medium term, due to the uncertainty of the wind energy resource. This led us to refine our own wind energy production forecast models in all time horizons, which, in addition to being an interesting forecast in itself, is also an essential input that allowed us to improve the accuracy of the price forecasts.

In recent months PV energy production has been facing a qualitative leap. How does AleaSoft participate with its forecasting services?

PV technology has been reducing the cost of the panels and increasing the efficiency of electricity generation. This implies that it is already profitable to produce electricity with PV generation.

This situation led to the resurgence of a sector, the PV, with the creation of hundreds of companies in the last two years. The future outlook is for this growth to continue. As we said on several occasions, we are in the presence of a PV Revolution, taking advantage of the fact that Spain has a privileged situation with more hours of sunlight and greater intensity than most European countries to which we are interconnected in an integrated electricity market.

These companies that arise and others that are growing must constantly make decisions and, as previously stated, we provide market information, forecasts in all time horizons, probabilities of forecasts and optimization. These are key factors that a strategic consultancy must provide in order to value and manage the PV assets.

In this way our services go beyond forecasts. We help our clients to interact with each other by contacting developers, manufacturers, banks, investment funds, consultants, marketers and large consumers. We also carry out optimization and feasibility studies of hybrid renewable systems with battery storage, to make the most of the energy produced.

How important are AleaSoft's forecasts for those who need to invest, build a PV or wind farm or buy electricity through a PPA?

First we are going to ask ourselves the question: what is the value of a PV asset? The answer is very simple: the market puts a price on that asset, and as we are talking about an asset that will work for tens of years, the only way to value it is knowing in the best possible way the price of the electricity market in the next 20, 30 or 40 years. If the market price over the next 20 years is €40 /MWh, the asset will have a different value than it would have if the price were €30/MWh. And in the extreme case that the future price was very low, the asset would be a problem for the developer.

Knowing the future forecast and the bands associated with a probabilistic metric gives confidence to the builder of the facility, to the one who finances it, to the one who invests and to the one who buys the electricity.

Obviously, the company that makes the forecasts and provides the probabilities must guarantee that they are scientific and demonstrate that they are consistent. Thousands of millions of euros depend on these forecasts, so the quality of them must be the maximum.

For any company in the energy sector, the forecasts and their associated probabilities constitute a vision for the future that must be guaranteed.

In recent months we developed tens of long-term price forecasting projects for PPAs for the main European markets and for all types of companies: developers, manufacturers, investment funds, banks, consultants, marketers and large consumers. Our long-term forecasts are bankable.

In addition to being leaders in short- and medium-term forecasts, our goal is to become world leaders in long-term forecasts

In order to operate the new renewable facilities, are AleaSoft's forecasts important?

Once the new installation is in operation, it becomes another generator company in the sector and must have an operation strategy. This strategy has two fundamental components, or going to market, or selling electricity at a fixed price. You can also consider the alternative of having coverage or not having it.

To determine the strategy to follow, it is necessary to have midterm price forecasts with their associated probabilities. In this way, the sale of the production can be done by maximizing revenues and managing risks in the face of possible price drops. The market works like a pendulum around an equilibrium point and you have to be prepared for periods of high and low prices.

In all horizons the price forecasts that we offer are of hourly granularity, so having the production pattern of the renewable power plant you can calculate the hourly income in the coming months and years. In this way, in addition, a dynamic valuation of the renewable asset, whether wind or photovoltaic energy, can be maintained.

In the future, the wind and PV energy generation, together with the production of green hydrogen, will replace fossil fuels in the domestic and industrial sectors and throughout transport.

With the rise in electricity prices in recent times, the electro-intensive industry and the large consumers in general were affected. How could AleaSoft help companies that are large consumers of energy?

We work with many companies that are large consumers of electricity and are having problems with the high prices of the electricity market. At the beginning of 2018 the CO2 emissions price began to raise, from a previous floor of just over €5/t to €28/t of average value in July of this year, the maximum monthly average value to date. The electricity market, being marginalist, takes as market price for one hour the last maximum price that matches, which usually belongs to a production with gas or coal, or a hydraulics that assumes a similar value. The offers of sale of gas and coal energy production take into account the price of CO2, so the price of these offers takes into account the increase of €20/t that took place with respect to the beginning of 2018. This increase affects all electricity consumers, but especially those that are electro-intensive, that is, to the industries in which an important part of the cost of producing is influenced by the electricity price.

The question in this case would be: what can these electro-intensive companies or large electricity consumers do? And the answer: having a vision of the medium- and long-term future of the electricity market price and taking the measures to face this complicated future. For example, in the midterm combining strategies such as buying in the futures market, making a bilateral contract, or going to the market. This can be done optimally considering the forecasts and their probabilities. The above is valid for a long-term horizon considering that a PPA is a bilateral contract.

Large consumers and electro=intensive companies can take advantage of this PV revolution to guarantee electricity with less cost in the future, as well as contributing to a cleaner planet. AleaSoft is helping this business sector to draw up a strategy for a sustainable future from an economic and environmental point of view. To start, it is necessary to have a long-term vision and think about having a PPA.

Is the marginal electricity market that we have fair?

Sometimes we hear that the Spanish electricity market can be improved or changed. Actually, when we talk about the electricity market, we refer to the European electricity market, which is one, transparent, with the same rules for everyone and that is increasingly integrated. In the coming years it will remain the same and will be even more integrated. It is the market that we have for more than 20 years and works excellently every day, every hour. It is a fair market, since it gets the agreement between the companies that produce and consume throughout the continent. One megawatt hour [MWh] that is produced on the eastern border of Poland can be purchased by a Lisbon retailer.

The market balance on which you base your forecasts, does it always work? And another: will it remain in the next 20 years?

Our electricity market is continental, with the advantages of being a very large and stable market. This allows analyzing the balances between supply and demand that occurred in the past and extrapolating them to the future. The market balance is the essence of a scientific model of market prices forecasting. That balance between supply and demand is fundamental. If the price falls, the demand is encouraged and investing in the market is discouraged. If the price goes up, the investment is encouraged and the demand is discouraged. If we think about it, this balance is inherent to the operation of the market itself, if both buyers and sellers do not get a fair price, the market stops working. This equilibrium point depends on the cost of producing each MWh and the demand for that MWh, and what our models do is anticipate how that equilibrium point will evolve in the future, which is the value around which the market price will move. We will keep this dynamic in mind for the next 20 years while we have the current marginalist market.

You also have to keep in mind that the market is not perfect. The cost of the MWh, and therefore the equilibrium point, can be distorted by disruptive elements external to the market such as capacity payments or renewable energy auctions. And we take into account the existence or possible existence of all this in the long-term forecasts.

The prices had and will continue to have oscillations. In Spain, the hydrological cycles directly influence the prices. If a hydrological cycle came with a lot of water, usually accompanied by more wind, the prices would fall.

Companies that buy and sell electricity have to take into account medium and long-term forecast models that have these cycles included in the future probabilities, which, as I stated before, must be quantified scientifically. To summarize, in the future we will see alternating high prices and low prices. That is why risk coverage is important, always keeping a part to go to the market if the previous strategy advises it.

We saw a graph with long-term forecasts made by AleaSoft in November 2010 that were fulfilled despite all the changes that occurred in these almost 10 years. Chance or science?

It is an example of the coherence of the forecasts based on scientific principles. When part of the forecasts takes into account the market balance in the past, stability and consistency in the results are achieved. On the contrary, if the model is based only on future assumptions, without taking into account that the market will be in equilibrium, the forecasts may be inconsistent because they will depend on the thousands of assumptions that are made.

In our methodology, in addition to taking into account that in the future the market will remain in balance, we also take into account the scenarios of some 15 fundamental explanatory variables and all the technological changes planned for the coming years, mainly the photovoltaic and wind energy generation that will gradually be incorporated, both in large parks and in self-consumption PV installations that will affect the volume and profile of electricity demand. We also consider energy storage, both with hydrogen and batteries.

What does AleaSoft expect (long-term price forecasts) in view of the massive introduction of renewable energies? Are your long-term forecasts “bankable”?

Our long-term price forecasts take into account current and structural dynamics. As I said on several occasions, we combine different forecasting methodologies: recurrent neural networks, Box Jenkins and the regression of classical statistics. This Alea model allows us to capture the balance point in the past and spread it into the future. It is the balance between the supply and the demand and a set of fundamental variables that influence the market price. Our long-term model is top down, an analysis of the macroscopic fundamentals that influence the price is performed and then it goes down to the hourly price form across the forecast horizon.

For the long-term price forecasts, we take into account the gap left by renewable energies when there is no sunlight and the wind does not blow. This is compounded in times of drought. It should be noted that, in addition to being leaders in price forecasts, we are leaders in demand forecasts and renewable energy productions: photovoltaic, wind and hydraulic energy. The quality forecasts of these fundamental variables are the basis of the forecast. In addition, not only it is necessary to calculate the forecasts, but also it is necessary to calculate the probability of each of the scenarios of these fundamental variables.

The long-term forecasts must be made jointly for all Europe. As part of this top down process as well, we first make long-term price forecasts for Germany and France to take into account the direction of the flows in the international interconnections.

As I said before, our forecasts are bankable. The tens of long-term forecast projects that we carried out for companies in the renewable energy sector of Europe, for almost all European markets, had no problem in obtaining financing from banks or investment funds. Similarly, banks and investment funds hired us directly or recommended us for the quality / price ratio of our forecasts. In addition to being leaders in short and medium term forecasts, our goal is to become leaders of long-term forecasts.

So that there is no doubt, I insist: for the long-term forecasts, we do take into account all the quantitative and qualitative changes that the energy market will face in the future.

Why is AleaSoft so involved in the topic of the future of the renewable energy? Future vision?

Our commitment to the future of the planet is the basis of all our activity. The environment is being destroyed with the emissions of CO2 and other polluting gases. It is not a “climate change”, it is a “destruction of the environment” and of the balances on which life on the planet is based.

Clean and renewable energies are the basis of a sustainable future. We have been in the energy sector for 20 years and we saw the wind and photovoltaic energy arrive as a hope that the change is possible. We help all companies related to renewable energy in making decisions based on medium and long-term forecasts. We also collaborate with the main associations that are related to renewable energy in Spain: with the Asociación Empresarial Eólica (AEE), the Unión Española Fotovoltaica (UNEF) and the Asociación de Empresas de Energías Renovables (APPA). We are sure that in the future the energies will be 100% clean and renewable.

AleaSoft proposes a future with green hydrogen manufacturing, in which highlights the importance of the regional development, of the energy export ... What can you tell us about these issues? How hydrogen can be incorporated in the future to stabilize the market?

The green hydrogen production is another revolution that, combined with PV generation, forms a clean and renewable future binomial in all sectors.

The manufacture of green hydrogen in areas of southern Europe, which are the most economically disadvantaged but with the greatest solar resource, is a basis for promoting regional development. The areas where energy is produced have more resources to develop knowledge. In the case of Spain, the southern areas have a unique opportunity to change if they introduce photovoltaic energy and green hydrogen production.

The green hydrogen produced by electrolysis has a strategic advantage: it will regulate the electricity market price in the long-term. If the electricity market price falls in the future, the production of green hydrogen will become more profitable which, as a consequence, will create an additional electricity demand that will balance the market so that it does not fall too much.

And that will be possible because the demand for hydrogen will grow tremendously. In the future, the wind and photovoltaic energy generation, together with the production of green hydrogen, will replace fossil fuels in the domestic and industrial sectors and throughout transport.

Spain, due to the wind and solar resource, is a mine to move from a net importer of energy and electricity to an exporter of electricity and green hydrogen.

AleaSoft is dedicated to looking towards the future. How does it see itself in the next 20 years?

Our vision is to be world leaders in forecasts in the energy sector. Forecasts for renewable energy production, energy demand and energy market prices. In all time horizons: short, medium and long-term. We have a novel methodology that we can export to all continents.

For more information: AleaSoft