SGRE climbed to second position according to Wood Mackenzie’s research, dominating the 1.9 GW UK offshore market and achieving over 1 GW of onshore installations in the US and Spain.

GE grew its global dominance by connecting projects in 24 markets, with first-ever turbine installations in Greece, Oman, Jordan, Kazakhstan and Chile reaching 8.7 GW. This is a 60% increase on 2018.

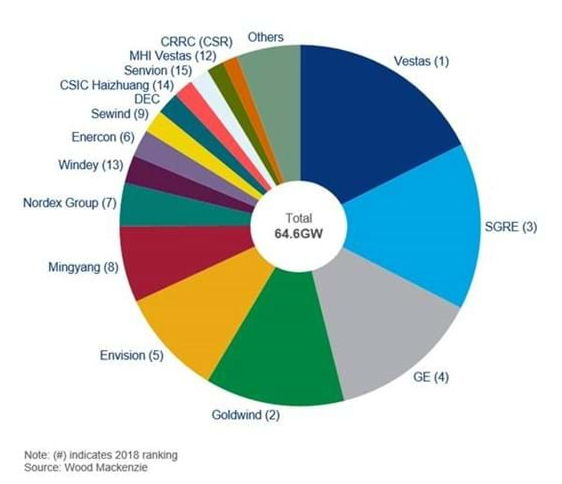

The Wood Mackenzie report, which determines global, regional and country wind turbine manufacturer market shares, reveals that 2019 was a year of market consolidation.

“The top five turbine OEMs – Vestas, SGRE, GE, Goldwind and Envision – increased their combined market share by 10% from two years ago, capturing 68% of global capacity,” said Shashi Barla, Wood Mackenzie principal analyst

Sitting just outside the top five, MingYang grew its market share by nearly three percentage points. The company doubled installations in China to 4.4 GW, including record offshore activity of over 500 MW driven by projects in Guangdong.

“China’s big three OEMs – Goldwind, Envision and MingYang – each recorded their highest ever installs in 2019. This challenged the West’s big three – Vestas, GE and SGRE – who also logged record installations last year.

“Supply constraints for China’s big three enabled tier II Chinese OEMs, such as Windey and CRRC, to make a surprise appearance in the global top 10 and top 15 rankings, respectively, for the first time.

“Despite eight Chinese OEMs ranking among the top 15 globally, only 0.6 GW of wind turbine capacity was exported. This illustrates China’s heavy dependence on the domestic market.

“Smaller regional players, including Senvion, Suzlon, INOX, XEMC and WEG, lost market share due to challenging market conditions. This resulted in financial difficulties that will jeopardise their future participation in the wind sector,” said Barla.

Despite a healthy outlook for the wind turbine supply chain over the next decade, the coronavirus presents near-term hurdles for OEMS.

“Wind turbine OEMs with exposure to global wind turbine supply chain hubs including China, India and Spain will see a negative market share impact in 2020. This is primarily due to coronavirus lockdown measures that have obstructed manufacturing facilities in these countries,” added Barla.