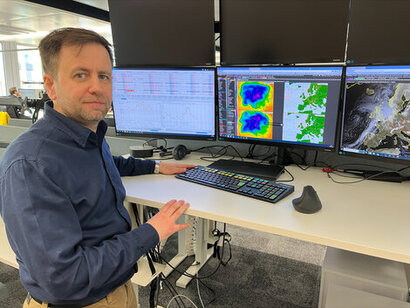

MET Group's Head of Meteorology, Vasilis Pappas, focuses on quantifying and analysing weather volatility, creating distinct scenarios based on different possible outcomes and, with the help of an experienced meteorologist picks the most likely scenario. Pappas also covers renewable energy with regard to the impact of weather on clean energy plants.

For example, with water being crucial for hydropower plants, disruption in the hydrological cycle can lead to water scarcity for large areas in Europe and across the world, also affecting continuity of energy supply. With regard to wind and solar, an increasing number of companies are looking at regional climate projections when deciding on the purchase or sub-lease of wind farms or solar farms, focusing particularly on the history of production data.

Can you tell me about yourself and about MET Group?

I studied physic and meteorology in Greece and the UK, having spent ten years in the UK and Germany, working at Scottish and Southern Energy, and in Germany at Trianel. I also worked in academia and research. I joined MET Group two years ago, I am based in the headquarters in Switzerland. We have more than 900 staff in 14 European countries, our revenues reached 41.5 billion euros in 2022. MET has activities in natural gas, power, and renewables, focused on multi-commodity wholesale, trading and sales, as well as energy infrastructure and industrial assets.

To what extent does MET Group get involved in renewable energy matters and is this a global perspective or limited to particular regions?

We have always been known for our activities in gas and LNG, but the renewable energy revolution is taking the world by storm, and we created MET Green Assets Division to meet this demand and because of our conviction that the energy transition is essential to combat climate change. MET is building a pure-play renewables portfolio in Europe with a target capacity of 2 GWs by 2026. With a declared focus on onshore wind and solar energy production, the Green Assets Division is present in eight European countries. We seek to increase our foothold in the European renewables market by expanding into additional countries where MET Group has subsidiaries, leveraging our understanding of these markets. We construct and operate solar and wind parks in Italy, Spain, Germany, Poland, Bulgaria, Romania, Serbia, and Hungary, and actively seek investment opportunities in ready-to-build assets as well as greenfield and brownfield sites.

A good example is the “Puerto Real 3” project in Spain. A solar power plant is being constructed in Andalusia, presently consisting of 88,000 solar panels, on a surface area of 130 hectares.

Can you say more about your role in this area and what it involves?

In the last 30 years, there has been a boom in renewables and so some of my role is studying which regions and countries to invest in by providing forecasts of the expected wind and solar production.

This analysis needs data such as wind speed and direction, solar radiation, temperatures, and we get that from weather stations, modelling data, satellites but also from open sources such as C3S, the Copernicus Climate Change Service which provides reliable information about the current and past state of the climate, the forecasts on a seasonal time scale, and the more likely projections in the coming decades for various scenarios of greenhouse gas emissions and other Climate Change contributors. We also use data from the European Centre for Medium-Range Weather Forecasting (ECMWF), one of the top research centres in meteorology and climatology.

To give an example on the planning side: when we look at locations for potential wind farms in Switzerland in the future, we may use data from atlases such as the one provided by Meteo Swiss on wind speed and direction and so be better able to assess optimum and less optimum locations but also different premiums for PPAs and indications of future revenues.

Aside from planning intelligence, we can also use data for operational purposes. Looking at an asset in Bulgaria for example, we can view a daily forecast which can tell us how much energy can be produced and so our traders can optimise their revenues by knowing the volume of energy that can be sold if it’s windy or less windy.

How difficult is it keeping an eye on weather patterns around the world simultaneously with regard to how they might affect renewable energy plants both operational and planned?

It is challenging in a global business with so many data sources. But we use AI and machine learning which can several days in advance highlight, for example, the risk of an extreme weather event. There are different weather models, mainly based on equations describing the physical interactions in the atmosphere, from various research centres around the world. The atmosphere follows the rules of chaos theory, so it can be argued that with an increased forecast horizon “all forecasts become wrong”. Therefore, we need to put resources into further statistical processing. The longer the forecast horizon, the bigger the volatility in the forecasts. Our in-house analysis investigates quantifying that volatility, creating distinct scenarios based on different possible outcomes and, with the help of an experienced meteorologist picks the most likely scenario.

Can you give some examples of weather-related incidents across the globe that have affected renewable energy infrastructure and thus caught your attention or even necessitated your active involvement?

Adverse weather conditions can cause shutdowns of wind farms. Too much wind can be dangerous, but also if the weather is extremely cold, ice may accumulate on the blades and the turbine needs to be shut down. Solar panels covered in snow clearly impacts output. The recent floods (September 2023) in Greece damaged solar panels. Up to 400 MW of installed capacity can be knocked out for 6 months. Dunkelflaute (or anticyclonic gloom) is a period in which little or no energy can be generated from wind and solar power because there is neither wind nor sunlight. This could happen typically in any winter in northern Europe. During that time, there is increased demand due to low temperatures, but that demand can only be met by thermal production (gas, coal, lignite) as well as hydro production from the reservoirs.

How can renewable energy infrastructure become more resilient in the face of increasingly extreme weather as climate change steadily becomes more serious?

The global warming seen in the last 30 to 40 years adds certain challenges to the energy markets. For example, there are several studies showing a disruption in the hydrological cycle leading to water scarcity for large areas in Europe and globally. Water is crucial for the energy sector – rivers are used for cooling purposes in nuclear and other thermal power plants, for producing electricity via run-of-river hydropower plants and for transporting coal and other fuels via barges. Therefore, low river levels immediately cause issues in the energy supply chain. Snowpack has been decreasing in the past few winters in Europe, and that has a direct impact on hydro resources to be used in the spring and summer.

Another important factor to resilience is how to optimally spread the portfolio across Europe. A wind farm in Spain could complement very well a wind farm in Germany – when it is very windy in one of the countries, it is usually not windy in the other one. And, of course, when renewable technologies go together with batteries for storing the excess renewable energy production and with flexible generation, such as gas-fired power plants, the supply of energy becomes very efficient. This is the case, for example, at the Dunamenti site owned by MET Group. There, we have a gas-fired power plant, a solar plant, a Tesla mega-battery, and an e-boiler.

How do you think your role in the sector will grow and change over the next ten years or so?

I think we will see even more data sources from different providers and sophisticated technology like AI will be used to crunch the data via more sophisticated models and techniques. Energy is a global market, and I think we will see more interconnectedness where renewable energy is balanced with other energy sources such as LNG or gas and companies are able to leverage meteorological forecasting to do that balancing.

For additional information: