This round of funding enables Highview Power to continue its aggressive global expansion and rapidly moves additional projects into the commercialization phase. Highview Power is entering the new year with a late-stage pipeline of over 4GWh of projects across the U.S., Europe, and Latin America. This is in addition to the current 700MWh of projects currently under development.

“Highview Power’s ability to secure financing from such high-caliber energy leaders, despite the challenges of the global pandemic, signals that the industry recognizes the immediate need for long duration energy storage, and more specifically for our CRYOBattery solution,” said Javier Cavada, president and CEO of Highview Power. “We are developing projects at an unprecedented pace, and we expect 2021 to be a pivotal year for the company.”

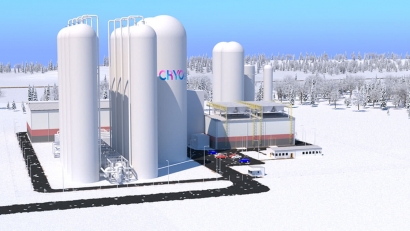

Highview Power’s energy storage facilities are based on its proprietary cryogenic energy storage technology – the CRYOBattery™, the only long duration energy storage solution that is being commercially deployed today. The CRYOBattery is freely locatable and can offer multiple gigawatt-hours (weeks) of storage. When paired with renewables, CRYOBattery facilities are equivalent in performance to – and could replace – thermal and nuclear baseload power.

“Leading utilities are starting to issue RFPs for 10 hours of storage to be cycled every day. Grid operators are starting to issue long-term contracts for the provision of synchronous stability services and constraint management. This is what is needed to make the energy transition a realistic proposition. And these things liquid air does better than any other storage system,” said Colin Roy, chairman of the Highview Power Board and a seed investor.

In addition to Sumitomo Heavy Industries, which previously announced its $46 million investment in February 2020, investors participating in the Growth Capital funding round include private investors and: