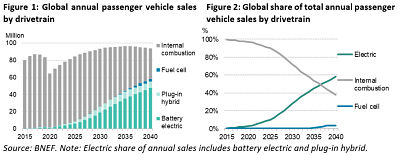

However, these findings should be seen in context, with sales of combustion engine cars set to drop even faster this year (by 23 percent), and the long-term electrification of transport is projected to accelerate in the years ahead.

The research by BNEF shows that electric models accounting for 58 percent of new passenger car sales globally by 2040, and 31 percent of the whole car fleet. They will also make up 67 percent of all municipal buses on the road by that year, plus 47 percent of two-wheelers and 24 percent of light commercial vehicles.

The figures have major implications for oil and electricity markets. Transport electrification, particularly in the form of two-wheelers, is already taking out almost 1 million barrels of oil demand per day and by 2040 it will remove 17.6 million barrels per day. Electric vehicles (EVs) of all types are seen adding 5.2 percent to global electricity demand by 2040.

“The Covid-19 pandemic is set to cause a major downturn in global auto sales in 2020” said Colin McKerracher, head of advanced transport for BNEF. “It is raising difficult questions about automakers’ priorities and their ability to fund the transition. The long-term trajectory has not changed, but the market will be bumpy for the next three years.”

BNEF’s analysis suggests that global sales of internal combustion engine, or ICE, cars peaked in 2017 and will continue their long-term decline after a temporary post-crisis recovery. For the first time, BNEF sees overall new passenger vehicle sales peaking in 2036 as changing global demographics, increasing urbanisation and more shared mobility outweigh the effects of economic development – though the fleet size keeps growing. Electric models are seen accounting for 3 percent of global car sales in 2020, rising to 7 percent in 2023, at some 5.4 million units.

Further falls in lithium-ion battery prices will mean that the lifetime and upfront costs of an electric car ‘cross over’ with those of ICE equivalents in around 2025, on average. However, the date will vary greatly depending on the market, as early as 2022 for large cars in Europe but 2030 or after for small ones in India and Japan.

This year’s Outlook breaks new ground in examining prospects for the growth of electric two-wheelers and fuel-cell vehicles, using hydrogen. It sees the latter technology accounting for 3.9 percent of heavy-duty commercial vehicle sales and 6.5 percent of municipal bus sales globally by 2040, but with higher shares in East Asia and parts of Europe. Fuel cells are not seen encroaching far into lighter-duty commercial or passenger car markets.

The report sees fully autonomous vehicles or ‘robotaxis’ beginning to play a much larger role in the late 2030s, helped by the growing deployment of advanced driver assistance systems, or ADAS, and the build-out of sensor supply chains.

“We’ve taken our closest look yet at electric vehicle charging infrastructure” added Aleksandra O’Donovan, head of electrified transport for BNEF. “We estimate that the world will need around 290 million charging points by 2040, including 12 million in public places, involving cumulative investment of $500 billion.”

BNEF estimates that home, workplace and private commercial charging will account for 78 percent of this investment. Investment in public charging infrastructure is seen as a cumulative $111 billion across all countries by 2040. Most of this can be provided profitably by the private sector as utilization rates rise in the 2020s, but government support may be needed in some regions.

There are currently over 7 million passenger EVs on the road, together with more than 500,000 e-buses, almost 400,000 electric delivery vans and trucks, and 184 million electric mopeds, scooters and motorcycles on the road globally. The majority of the e-buses and electric two-wheelers on the road today are in China.

The report also discusses the impact of the coronavirus crisis on public transit. It sees more than a short-term effect as lockdowns ease. Instead, there is likely to be a lasting reduction in ridership of municipal bus and metro services, and more traffic congestion in cities. Shared mobility operators have suffered, but will rebound quickly on the back of food delivery, logistics and micromobility services.

For additional information: