“Reaching the trillion dollar milestone is a key moment for the sustainable debt market – if this market wasn’t already on the radar of major global investors, it will be now”, said Angus McCrone, chief editor at BNEF. “This is just the beginning – while it took 12 years to find the first trillion dollars of sustainable debt capital, it will take much less time to reach the second trillion.”

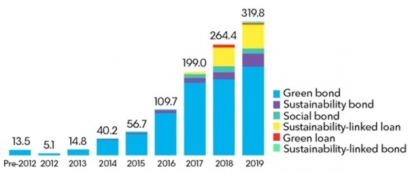

Green bonds, which debuted the sustainable debt market in 2007, remain the most popular financing option by dollar volume. Green bond issuance totals $788 billion to date, representing 77 percent of the sustainable debt market. Other innovations in the sustainable debt market include sustainability bonds (7 percent), sustainability-linked loans (10 percent) and sustainability-linked bonds (

Sustainability-linked debts are a new innovation that offer explicit price incentives to borrowers or investors. Italian utility giant Enel SpA was the first company to issue a sustainability-linked bond, with a $1.5 billion security sold in September 2019. Enel has committed to boost the interest rate the bond pays if it fails to meet its own renewable energy generation targets.

“The sustainability-linked model is a crucial development for the sustainable debt market,” said Mallory Rutigliano, a green and sustainable finance analyst at BNEF. “The bonds and loans are considered sustainable not because of the use of proceeds, but because of how the borrower commits to making sustainability improvements. With the transition to a lower carbon economy and inclusive growth on the agenda of many major companies, the concept is gaining traction.”