Fortune 500 companies have awakened to the potential of purchasing low-cost, reliable renewable energy in the last four years. Recently, major corporate renewable energy announcements have flooded in: Google announced it will run entirely on renewable energy in 2017, and 95 percent of that will come from wind. General Motors will use wind to power a Texas factory that makes 1,200 SUVs a day like the Tahoe and Escalade. Eighty-three companies including GM, along with Amazon, Microsoft, Mars, and others have committed to go 100 percent renewable.

AWEA’s new report Evolution of the Corporate Wind PPA: Market Insights looks behind the recent headlines, revealing how America’s leading brands are powering their business with wind. The report features never before collected details on corporate power purchase agreements (PPAs), essentially long-term contracts to buy energy, and a tool that many companies use to buy renewable energy from a specific wind or solar project. AWEA researchers surveyed 23 companies who have signed PPAs to power their business.

“In recent years Fortune 500 companies have led an intense search for the best ways to buy more clean energy” said AWEA CEO Tom Kiernan. “And when big-named brands buy clean energy, they overwhelmingly choose wind because of our reliable, low cost. Survey after survey shows Americans want more wind, and we want them to know brands behind the well-known products they buy — Amazon, General Motors, Google, Walmart and many more — are already wind powered.”

Hannah Hunt, lead author of the report and Senior Analyst for AWEA, added that wind power is the energy source of choice among these companies by a factor of six to one. The reason for this is that wind power is available in large amounts, is inexpensive, and can be acquired through stable long-term contracts (PPAs). This means that wind offers a fantastic deal for businesses seeking to provide some of the least expensive electricity out there. Since there is no fuel cost, buyers know up front what price they will pay for wind energy 10 or 20 years down the line.

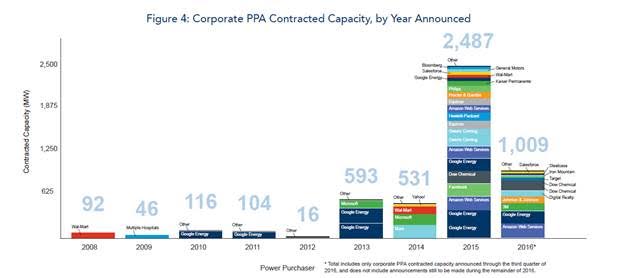

Out of a total 6,002 MW purchased from specific wind projects, approximately 5,000 MW has been purchased through PPAs. The remaining 1,002 MW were acquired through direct ownership or other means.

“Members of the Fortune 500 know how to get results and they have applied that mentality to clean energy,” said Hannah Hunt. “We now know how and where they have gone about buying 5,000 megawatts of wind power through PPAs. The bulk of wind projects built to serve the Fortune 500 are located from Texas, up through the rural heartland and across the Rust Belt. That’s where some of the best wind resources are. It also happens to be part of the country hurting for jobs and private investment. When these companies invest in a wind farm, they invest in a community. For example, when Iron Mountain brought a data center to southern Pennsylvania, they also invested in a wind farm in the state — that’s two multi-million dollar boosts into the Rust Belt economy where previously there was one.”

Generally speaking, companies need a lot of energy to power their retail stores, manufacturing facilities and data centres. Roughly 80 percent of wind capacity purchased by corporate customers is located in the same electricity market where at least some of the companies’ demand comes from.

According to Hunt, American companies aren’t standing by waiting for clean, cost-effective energy either. They have applied market-leading innovation to develop new financial tools, including virtual power purchase agreements, to get projects built where and when they might otherwise not be.

AWEA’s research found that many corporate customers are moving from traditional “physical” PPAs, where energy is delivered directly along power lines, to virtual PPAs which are financial transactions. This flexibility allows companies to invest wind and other clean energy projects in parts of the country where they wouldn’t have been able to do so before due to regulatory limits.

For additional information: