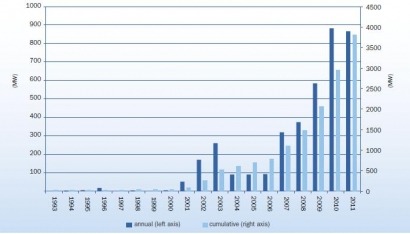

EWEA has published its annual offshore wind statistics for 2011 in Brussels (Belgium) showing that 235 new turbines with a total power capacity of 866 Megawatts (MW) were fully grid connected across nine offshore wind farms.

Nine offshore wind farms currently under construction will bring online an additional 2375 MW - increasing the EU's total installed offshore wind power capacity by 62%.

Annual installed new offshore wind turbine capacity (fully grid connected)

![]()

Source: EWEA

Across the EU, a total of 1371 offshore turbines have now been grid connected, with a total power capacity of 3813 Megawatts in 53 wind farms in 10 European countries.

EWEA's target for installed EU offshore wind power capacity by 2020 is 40,000 MW, producing approximately 4% of the EU's total electricity consumption.

"The offshore wind sector witnessed a stable market in 2011", said Justin Wilkes, Policy Director of EWEA. He added: "Despite the economy-wide financial squeeze, 2011 saw a 40 per cent increase on the previous year in offshore non-recourse debt financing*, up from 1.46 billion Euros in 2010 to 2.05 billion Euros in 2011."

"The strong project pipeline and financial developments highlight the importance of countries continuing to provide and develop stable long-term frameworks for offshore wind power in order to allow the industry to continue its development," he went on.

The majority (87%) of all newly installed and grid connected offshore wind power in 2011 was in British waters. Siemens supplied 80% of the MW installed offshore last year while SSE and RWE Innogy were the most active developers and DONG Energy continued to be the most active equity player in offshore wind power.

* Non-recourse debt financing describes a loan where the lending bank has the right to be repaid only from the profits and assets of the offshore project that is funded by the loan. The lender is not entitled to be repaid from other assets of the borrower.

For additional information:

The European offshore wind industry key 2011 trends and statistics